lhdn e filing tax agent

Special rental income tax exemption for YA 2021. Filing Programme For The Year 2021 Amendment 42021 Return Form RF Filing Programme For The Year 2022.

Federal Income Tax Refunds May Be Delayed By Stimulus Mistakes Paper

Personal Income Tax e-Filing for First Timers in Malaysia MyPF.

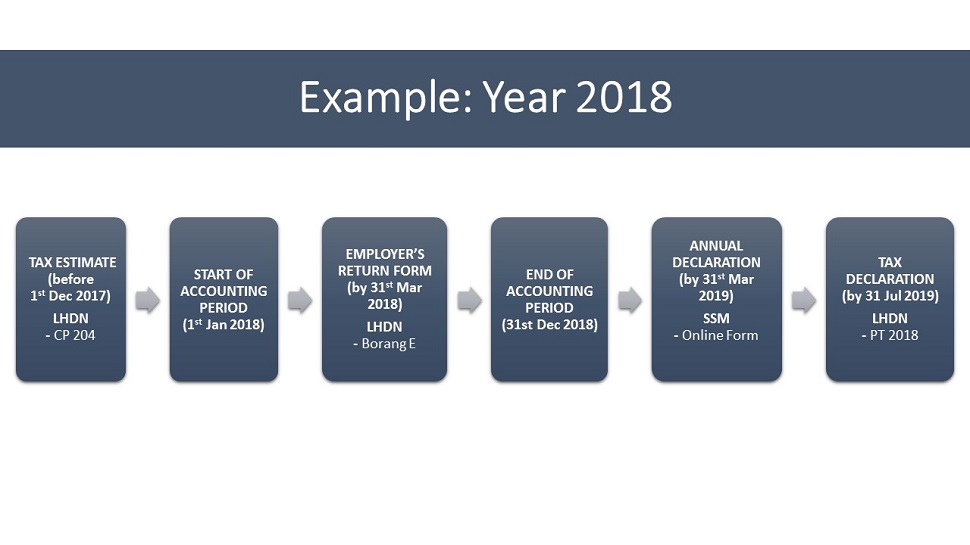

. Form used by company to declare employees status and their salary details to LHDN Deadline. Return Form RF Filing Programme For The Year 2021 Amendment 42021 Return Form RF Filing Programme For The Year 2022. Check out last years tax rebates here.

On the First 50000 Next 20000. Filing Programme For The Year 2021 Amendment 42021 Return Form RF Filing Programme For The Year 2022. E-Lodgement CKHT e-Form Login.

Filing Programme For The Year 2021 Amendment 42021 Return Form RF Filing Programme For The Year 2022. On the First 70000. Profession As A Tax Agent.

Automatic Exchange of. Real estate agent commissions. Generally tax reliefs are portions of your income that do not need to be included in the calculation of your taxes.

Bayaran Cukai Keuntungan Harta Tanah Available in Malay Language Only Tax Agent. However tax payees still need to file the returns. E - P a y m e n t e-Payment via FPX.

Profession As A Tax Agent. Appointment Of Tax Agent By Taxpayer. Your filings for tax relief from life insurance premiums will be subject to approval from the Inland Revenue Board of Malaysia LHDN so remember to.

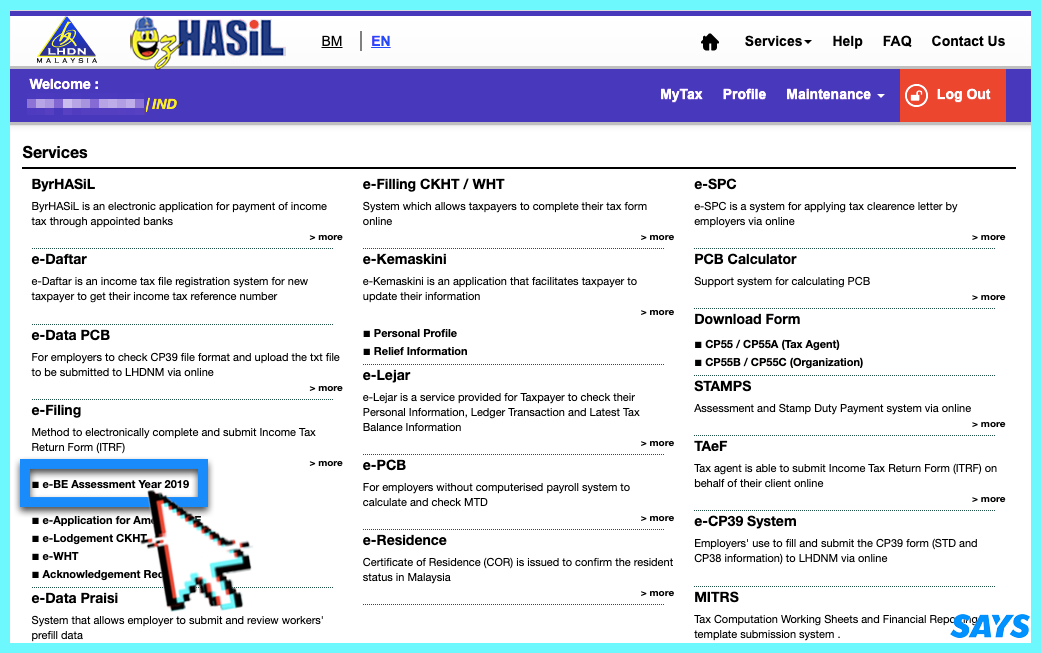

E-Filing Organization Download CP55B CP55C. Profession As A Tax Agent. Filing Programme For The Year 2021 Amendment 42021 Return Form RF Filing Programme For The Year 2022.

Income Tax File Registration. Appointment Of Tax Agent By Taxpayer. Appointment Of Tax Agent By Taxpayer.

Automatic Exchange of. E-Filing Prefill Data Login Prefill e-Data e-Filling. Profession As A Tax Agent.

2B-LHDN-01 Aras 2 Pusat Transformasi Bandar UTC KOMTAR. Submission of e-Daftar supporting documents can also be made via our e-daftar. 2022 Malaysia Income Tax e-Filing Guide For Newbies CompareHero.

Profession As A Tax Agent. Profession As A Tax Agent. - Handling external and internal audit on finance matter - Risk Management.

E - P a y m e n t e-Payment via. E - Janji Temu. Profession As A Tax Agent.

- Manage tax related matter. Intended to reduce the employees burden to pay in one lump sum the PCB deduction is normally not enough to cover the actual tax payable by tax payees. Register of members minutes books share certificates statutory returns and forms etc.

Filing Programme For The Year 2021 Amendment 42021 Return Form RF Filing Programme For The Year 2022. The Inland Revenue Board is also known as Lembaga Hasil Dalam Negeri LHDN by the local people living in Malaysia. Purchase of basic supporting equipment for disabled self spouse child or parent.

Appointment Of Tax Agent By Taxpayer. Form BE Income tax return for individual who only received employment income Deadline. 30042022 15052022 for e-filing 5.

Income tax return and Inland Revenue Board filing. Procedures For Submission Of Real Porperty Gains Tax Form. Bayaran Cukai Keuntungan Harta Tanah Available in Malay Language Only Tax Agent.

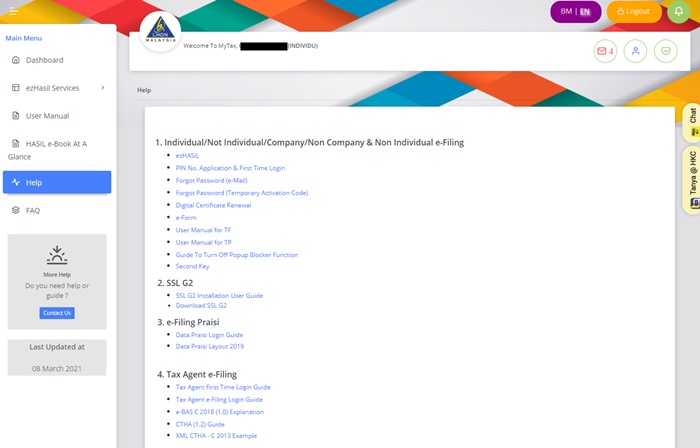

What are the income tax rates for expatriates and non-residents. E - Filing Tax Agent First Time Login Login Download CP55 CP55A. In September 2021 the government.

Please ensure you have submitted your e-Daftar application before submitting the supporting documents using the feedback form. You can learn how to file your income tax in Malaysia using LHDN e-filing with our complete guide and get the latest list of official tax reliefs for YA2021. E - Janji Temu.

E-Daftar is an income tax file registration system for new tax payer to get their income tax file number. List of income tax relief for LHDN e-Filing 2021 YA 2020 To make it easier for you to plan manage and file your income tax below is a list of tax reliefs for YA 2021 by category. Education fees Self Other than a degree at masters or doctorate level - Course of study in law accounting islamic financing technical vocational industrial scientific or technology.

Profession As A Tax Agent. To facilitate communication via our 1 300 88 3010 telephone service. Book debts benefits to legal rights and goodwill.

Filing Programme For The Year 2021 Amendment 42021 Return Form RF Filing Programme For The Year 2022. E - Janji Temu. According to LHDN Income Tax Rates page the chargeable income tax in Malaysia for Year Assessment 2021 follows the following table.

Appointment Of Tax Agent By Taxpayer. Profession As A Tax Agent. E-Filing Organization Download CP55B CP55C.

Once the company conducts its business activities it is a must that they get themselves registered with Inland Revenue Board. These deductions are intended to reduce the employees burden by making monthly tax payment in advance to LHDN. Procedures For Submission Of Real Porperty Gains Tax Form.

- Ensure that the Companys annual return audited financial statements returns and forms are prepared in accordance with the provisions in the Companies Act and other Regulations. E - Filing Tax Agent First Time Login Login Download CP55 CP55A. Appointment Of Tax Agent By Taxpayer.

Assist in counterparty risk assessment risk review and monitoring data management Controlling functions - analysis and advice on cost - FX related matter and reporting. Appointment Of Tax Agent By Taxpayer. Receipts and matching of USD trade proceeds.

Tax relief lowers your deductible annual income to reduce the amount of taxes which youll have to pay. Profession As A Tax Agent. 31032022 30042022 for e-filing 4.

- Maintenance and safekeeping of statutory records ie. Select Accounts Banking then select Bill Payment. How much is taxable income in Malaysia for Year Assessment 2021.

Shares of other companies and of non-tangible property eg. A s s i s t a n c e e. Form B Income tax return for individual with business income income other than.

RF for Year Assessment 2021 via e-Filing for Forms E BE B M BT MT P TF and TP Forms commences on March 1st 2022. How to make a LHDN payment. Appointment Of Tax Agent By Taxpayer.

E - Janji Temu. Appointment Of Tax Agent By Taxpayer. Appointment Of Tax Agent By Taxpayer.

Kindly click on the following link for more information on Return.

The Ultimate Guide For Running A New Llp In Malaysia Mr Stingy

The Advantages And Disadvantages Of E Filing The Money Magnet

7 Tips To File Malaysian Income Tax For Beginners

How To File Income Tax For The First Time

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Steps To Apply E Pin Online L Co

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Malaysia Personal Income Tax Guide 2021 Ya 2020

Checklist For Malaysia Tax E Filing Finposts Com

3 How Do I Complete And E File The Corporate Income Tax Returns Form C S C Youtube

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Pdf The Effects Of E Service Quality On Users Satisfaction A Case Of E Filing At Lhdn

Lhdnm On Twitter E Newsletter Hasil Edition 1 2022 Click The Link Below For The Pdf Version Https T Co Yvgxlwgshg Lhdnm Lhdn Eduzonehasil Https T Co Swvoloycga Twitter

Just An Ordinary Girl How To Do E Filing For Income Tax Return In Malaysia

How To File Your Income Tax In Malaysia 2022 Ver

Complete Malaysia Personal Income Tax Guide 2018 Ya2017 Comparehero

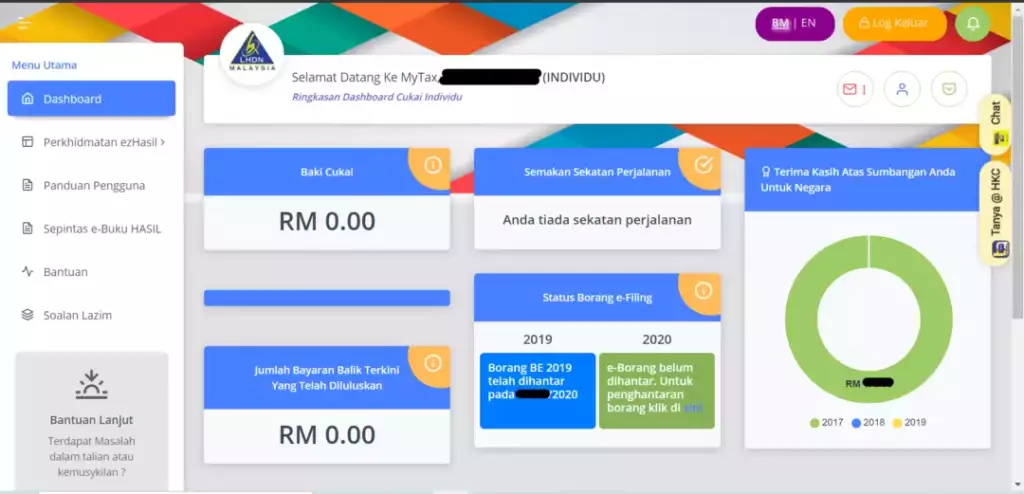

Mytax One Stop Portal To Make Tax Filing More Convenient

Kt Ng Associates Chartered Accountants

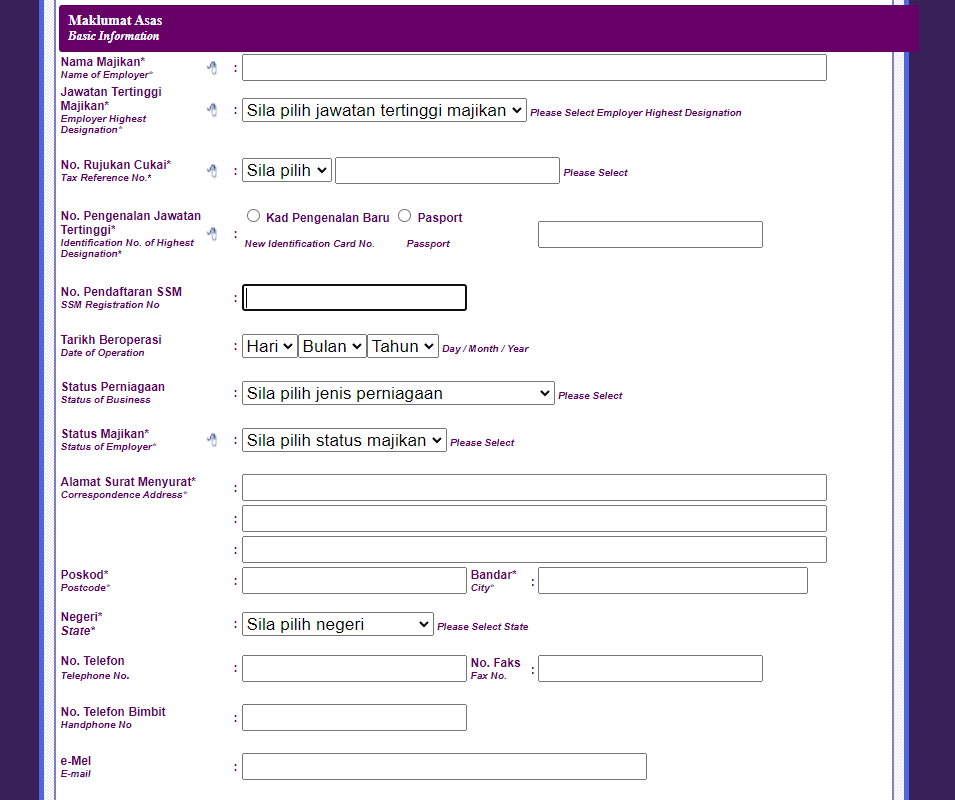

How To Register Lhdn Employer Tax File Number No Majikan Bossboleh Com

0 Response to "lhdn e filing tax agent"

Post a Comment